Electricity Market schemes

There are many kinds of electricity market schemes in use around the world. However, they differ in the market details. Most markets can be categorized into one of the following:the Marginal Price (MP) scheme, or the Pay-as-Bid (PAB) scheme. Each scheme has a different way to deal with participants in the market. These different market schemes will have different effects on participating solar plants. From literature, both schemes can be categorized in having three phases: the Day Ahead (DA) phase, the Congestion Management phase, and the Real Time (RT) phase. In most of the MP scheme, congestion management is done at the same time as the DA phase ; also congestion management can be handled in a separate congestion management phase (i.e. Spain, Brazil). In the PAB scheme, the UK market stands as the best example where congestion management is done in a congestion management phase only. However, this research will also propose creating a PAB scheme that will deal with congestion during the DA phase. The detail of each scheme is discussed later in this section.

Marginal Price (MP)

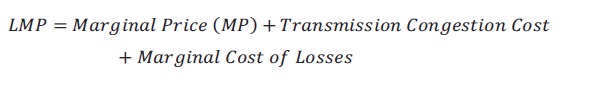

In the Marginal Price (MP) Scheme, there is one settlement price when the market reaches a resolution after producers and consumers submit their bids. This price is called the market clearing price (also called settlement price or Marshallian price) where the quantity of supply and demand is equal.If the power transfer in a transmission line within the electricity grid reaches its capacity, then the transmission line is considered to be congested. To relieve congestion the Independent System Operator (ISO) will request generators in the uncongested area to stop increasing power production, while ISO will request generators in the congested areas to produce more power. This means that the expensive generators at congested areas will have to operate. As a result, this will cause these areas to have higher prices. Dealing with congestion at DA (and RT) uses Locational Marginal Price (LMP). Shahidehpour defines LMP as “the marginal cost of supplying the next increment of electric energy at a specific bus considering the generation marginal cost and the physical aspects of the transmission system”. In literature, there are different names for LMP like shadow price and the bus Lagrange multiplier. To simplify the above definition, it can be said that the bus LMP is the cost of re-dispatching generators in the whole grid when adding an extra 1 MW load to that bus. Generators that produce the last MW in every location of the congestion are called marginal units, as they are the units that set the LMP at their location in the grid. As a result of congestion, there will be a split in prices in the system, as cheaper generators in some nodes cannot deliver power to the expensive nodes of the system. In order to understand LMPs, it is important to understand LMP components and how to formulate the LMP equation. Each LMP has three components, as seen equation ( 1.1) (see Appendix A for detailed

discussion) :

a) System marginal cost, which is typically the marginal cost (MC) at the reference bus.

b) System power loss cost from reference bus, which is due to power loss in the transmission

line.

c) Transmission congestion cost, which is the cost of re-dispatching due to reaching the transmission line capacity.

( 1.1)

Generators will achieve maximum profit by bidding their Incremental Cost. The proof is discussed in details in Appendix A. Transmission Congestion Cost is the cost of re-dispatching marginal generators to relieve congestion from a transmission line as discussed earlier. Marginal Cost of Losses is the cost associated with transmission line losses, which is usually small, so they are not considered in this work. The MP scheme can have one of two structures. The first structure has two energy markets: the Day Ahead (DA) market and the Real Time (RT) market. The DA market schedules the expected amount of production, while the RT market deals with the imbalance energy between the scheduled energy amount and the actual delivery amount. These markets clear in almost the same way. In each market supply bids (generation increases or consumption decreases) and demand bids (generation decreases or consumption increases) are settled to a LMP at each node on a determined settlement time that differs by market (i.e. some are hourly, some every half an hour, and some every 15 minutes) . In the DA market settlement obligates participants to produce a specific amount of energy at the LMP. In the RT market, deviations from DA settlement are settled against appropriate bids which will pay based on the RT LMP value . Typically demand is treated as a price taker as it does not set the price. The MP scheme is used in PJM, ERCOT, CAISO, NYISO, and in many countries in Europe. In this scheme, typically congestion is dealt with during both DA and RT. The second structure of MP schemes consists of three phases: a DA market in which the market settles to a market price without considering congestion, a congestion Adjustment Market (AM) (also called a counter-trading market, or congestion uplift market),then a RT market that deals only with supply-demand deviations . Examples of the second structure are Spain and Brazil .The difference between these MP structures is that the first one deals with congestion in a single settlement at the time of market clearing price in which the LMPs are created, while the second structure will not deal with congestion at DA and will have a uniform market price, then the ISO will deal with congestion after the DA market is closed and before RT starts. In this research, both congestion management schemes are studied.

Pay-as-Bid (PAB)

In the PAB scheme, participants pay or get paid only their bid price . It is believed that PAB limits producers from exercising market power . Currently, markets that use this scheme include the UK market and Iranian market. The UK market is the most well known market and has been using the PAB scheme since 2001. Similar to the MP scheme, PAB scheme can have DA, AM and RT markets. However, the term “gate closure” is used more often in this scheme, where gate closure is defined as “the last chance to bid or adjust a bid”. Although the period before the gate closure takes place just a few hours before the actual delivery, it can be considered similar to the DA market in the MP scheme. The period between the gate closure and the actual energy delivery is the adjustment market (AM), where the ISO adjusts the scheduled generators to relieve any possible transmission system congestion. Finally, the actual delivery is similar to the RT market in the MP scheme with an adjustment market. (The existing UK model is similar to the second MP structure, in which the gate closure marks the end of the DA market).Although there are different papers that support each scheme, one of the main claimed advantages of the PAB scheme is its ability to limit the effect of exercising market power by suppliers. For example, during the DA market in a MP scheme, if a marginal unit exercises market power then this unit will set a high market price and all consumers will pay that price. Unlike the MP scheme, in a PAB scheme if a unit exercises market power, then the effect is limited as only the consumers that accepted that high bid would pay the high price. One disadvantage of the PAB scheme is that it encourages suppliers to over-bid in an attempted to maximize revenues as every supplier tries to exercise market power by predicting the market price. Hence, some low efficiency generators might be dispatched while some high efficiency generators with a high bid price might not be dispatched. In general, in the MP scheme suppliers are motivated to bid low prices as they are guaranteed the market price, while in PAB suppliers are motivated to bid as high as they can. In the DA market, energy is traded for a settlement period in the electricity market (half an hour in UK case). Energy is traded for the settlement period until gate closure (in the UK gate closure is currently set to an hour before the settlement period). Also, energy is traded as blocks of an electricity amount (quantity) and a price in the electricity market. When another market participant accepts a bid, only the bid price is paid, as there is no market clearing price.At or before gate closure, participants must submit their contracted amount and price to the Independent System Operator (ISO). In the UK market, this is called the Final Physical Notification (FPN). They may also submit an adjustment bid, also called a supply- demand pair-bid (SDPB), which gives an adjustment price if the ISO asks the bidder to deviate from FPN volume.Between gate closure and Real Time (RT) market, the Adjustment Market (AM) begins.During the AM, the ISO runs calculations to ensure that the transmission system constraints are met. If transmission line congestion is determined, the ISO will request producers that submitted an adjustment bid (SDPB) to relieve congestion by redispatching in the most economical way. The cost of relieving congestion is distributed among consumers based on their consumption (prorated).In the PAB scheme, during RT the Independent System Operator (ISO) role is to balance power in case of any power mismatch between supply and demand. The ISO will request some generators to economically re-dispatch based on their submitted adjustment bid (SDPB) in order to achieve the power balance. Participants that deviate from their DA amount will pay the RT price (balancing price). The RT price depends on the cost needed to balance the system, which will depend on the accepted adjustment bid. The RT price will be the weighted average price of used adjustment bids. Suppliers and consumers may not intentionally deviate from FPN unless instructed by the ISO. Current UK scheme deals with congestion at the AM and RT only. This research will introduce a second structure that deals with congestion at the DA market. ISO collects all bids till gate closure time then an OPF will be run to reach a market settlement solution in which no transmission line limits are hit, and all accepted bids would be paid based on their bid. The benefit is to deal with congestion ahead of time to avoid any dispatch cost in an AM.Since UK market is the leading model for PAB, it is worth understanding how they specifically handle RT market. The UK RT market has dual pricing. A “main price” and a “reverse price” are calculated. This dual pricing mechanism is employed to encourage suppliers not to deviate from their contracted amount and made in a way that penalizes those who are contributing to system mismatch. The UK RT main price calculation depends on using accepted qualified adjustment bids (SDPB) that were submitted before gate closure and were used during the RT (which was discussed in a previous paragraph). The reverse price is the weighted average price of qualified transactions done at DA. The qualified adjustment bids must exceed a MWh threshold (in the UK market it must be above 1 MWh). It uses only the most expensive MWh to calculate the price of accepted adjustment bids (i.e. in the UK market it is set for the most expensive 500 MWh). It can be observed that the reason for using “qualified bids” is to avoid price spikes. Also since only the most expensive adjustment bids (SDPB) are used in calculating the main price, the price will be near but not equal the to RT settlement price in MP scheme. The UK RT market has many stages to calculate the main price that makes sure price spikes will not affect the main price. For more details read [37]. The RT reverse price in PAB depends on the average price of qualified accepted bids at DA. The qualified bids are bids that are above a MWh threshold (in the UK market it is above 25 MWh), not exceeding a maximum duration (i.e. in the UK market the bid duration shouldn’t exceed 4 hours), and not far away from away from gate closure (in the UK market bids between 0-20 hours before gate closure are used in price average calculation). If the RT market was short (generation is less than consumption), the main price will be used for generators that are under-generating, and the reverse price will be used for generators that are over-generating. If the market was long (generation is more than consumption),then the main price will be used for generators that are over-generating, and the reverse price will be used for generators that are under-generating . Having dual pricing that depends on whether the system was short or long is to penalize market participants that are contributing to the system mismatch.It can be observed that since the main price depends only on the prices of the highest accepted adjustment bids in RT, it should have a value that is close to MP RT price. Also,the reverse price depends on the highest accepted bids in DA (bids that are close to gate closure), which should have a value that is close to MP DA price (quasi MP DA). This means that both prices are expected to be close to each other. It seems like the goal is to heavily penalize those whose deviation is contributing to the power imbalance. That is why they pay the main price, while those whose deviation is helping in minimizing the imbalance will pay the reverse price (which depends on DA price).Participants who intentionally deviate from their FPN will face a special penalty by the ISO as such a practice can cause system instability. In general renewable energy deviation is not considered intentional. For this work, the PAB scheme will use a simplified UK market scheme that retains its major features. Unlike MP where the revenue is simply the settlement price multiplied by demand (see Figure 7), the PAB revenue will be the area under the bidding function as seen in Figure 8. All bids will be considered qualified, as [39] showed that only 11 bids in a full year did not meet the MWh threshold. A perfect competition market will be assumed, i.e. no generator will try to exercise market power. The settlement period will be set to one hour in order to have a better comparison with the MP scheme. It is expected that the price in the PAB scheme will increase as time approaches gate closure as available power supply gets less and less.

Figure 7 The revenue of producers in MP scheme

Figure 8 The revenue of producers in PAB scheme

Hybrid scheme between MP and PAB

There are markets that combine both the MP and PAB schemes. An example of this market is the Nordic market. It has two markets: ELSPOT represents MP, and ELBAS represents PAB. ELSPOT is the main market, which is also the DA market where “gate closure” is in the day before the actual delivery. ELBAS is open till one hour before actual delivery. There are many restrictions in ELBAS. Trading is only done at the same local transmission system operator until ELSPOT closes and publishes the available capacity of transmission lines. Then ELBAS (bilateral settlement) can accept trades outside the bidding zone until it hits the transmission capacity . Thus ELBAS is a Transmission Line constrained PAB. During RT, the market price is based on MP method. Since there can be many versions of hybrid schemes, this will not be studied in this research

https://digital.lib.washington.edu/researchworks/handle/1773/38615