cost of electric energy storage

technologies

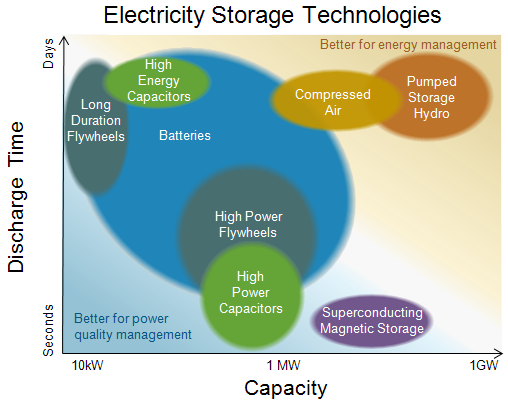

The increased penetration of supply derived from variable renewable energy resources, coupled with the recent decline in the cost of electric energy storage technologies, has brought about an opportunity to signicantly reduce the cost of managing the electric power system through careful planning, deployment, and operation of storage resources. Broadly, the short-run value of energy storage derives from its ability to arbitrage energy forward in time, enabling both the absorption of power imbalances on short time scales and the more substantial reshaping of supply and demand proles over longer periods of time. The extent to which the deployment of a collection of energy storage devices might benet the power system depends critically, however, on the collective sizing, placement, and operation of said devices . The challenge resides in the design and implementation of electricity markets and instruments that induce strategic expansion and operation of storage in a manner that is consistent with the maximization of social welfare over both the long and short run, respectively.The coordinated optimal dispatch of a collection of distributed energy storage resources clearly offers the possibility of a sizable reduction in the cost of servicing demand by reshaping it in such a manner as to alleviate both transmission congestion and the reliance on peak power generation . Of interest then is the characterization of mechanisms for the integration of storage, which encourage its efficient operation. And of critical importance to this effort is the resolution of the question: who commands the storage? Among the variety of possible answers to this question, there are two extremes differing in terms of the degree of government intervention which we naturally refer to as competitive and regulated.Each implies a distinct mechanism for both the operation of the physical storage facilities and the remuneration of the services provided.Broadly, the competitive or market-based operation of storage entails a decentralized operating paradigm in which storage owners pursue their own rational (prot maximizing) interests in the spot energy market. A shortcoming of such approach to storage integration derives from the uncertainty in revenue that storage owner-operators might obtain from the spot market. Energy storage is a capital intensive technology. And several recent studies have indicated that the risk of incomplete capital cost recovery due to such revenue uncertainty may serve to inhibit investment in storage facilities. Sioshansi also goes on to show that a complete reliance on the spot energy market to guide the integration of storage may lead to its substantial underutilization relative to the social optimum, as strategic owner-operators of storage will naturally endeavor to preserve intertemporal price differences for purposes of arbitrage. The regulated operation of storage, on the other hand, calls for a centralized operating paradigm in which storage is treated as a communal asset that is centrally dispatched by the Independent System Operator (ISO) to maximize social welfare subject to its physical constraints.1 The socially optimal dispatch of storage, in concert with conventional generation and transmission, naturally improves upon the welfare of the system in the short run. Accordingly, such an approach to the operation of storage necessitates the creation of a mechanism capable of extracting and redistributing the value added by storage back to the owners of the responsible storage facilities. Towards this end, we propose a market mechanism founded on the denition of tradable nancial instruments, which monetize property rights to storage capacity made available to the ISO for centralized operation. Such an approach resembles the regulation and operation of transmission in the majority of US electricity markets, which entails the centrally optimized operation of the transmission network subject to the locational marginal pricing of energy, and the allocation of nancial transmission rights that monetize property rights to said transmission capacity.

Open Access Energy Storage

There has been recent activity in both academia and industry to identify alternative paradigms to support the efficient integration of storage into power system operations. One stream of literature centers on an open access approach to the integration of storage; or more simply, open access storage (OAS) .Loosely, we refer to OAS as a regulatory framework in which energy storage facilities are treated as communal assets accessible by all participants in the wholesale energy market. To the best of our knowledge, only two concrete approaches to OAS have been proposed. He et al.proposes a market framework where storage owners sell physically binding rights to their storage capacity through sequential auctions coordinated by the ISO. The collection of physical rights, which are dened as a sequence of nodal power injections within a specied time horizon, determine the actual operation of the storage. As such, the physical rights associated with a particular storage facility must be collectively feasible with respect to the corresponding physical device constraints. While such physical rights might be used by market participants to execute price arbitrage or mitigate the cost of honoring existing contractual energy commitments, there are several important limitations. First, the ability of a market participant to leverage on a physical storage right depends on her location within the network relative to the storage facilities. Such restriction could serve to limit market access. Second, the eventual physical dispatch of storage is determined by a sequence of auctions the outcome of which is likely to substantially deviate from the socially optimal dispatch, because of strategic interactions between parties bidding for physical storage rights. Closer to our proposal, Taylor suggests an approach to OAS that centers on a paradigm in which storage owners sell nancially binding rights to their storage capacity through an auction coordinated by the ISO. The ISO is charged with the task of operating storage in a socially efficient manner not unlike its non-discriminatory operation of the transmission network. As nancial rights, they do not interfere with the optimal operation of storage, but rather, they represent entitlements to portions of the merchandising surplus collected by the ISO. A central component of the proposal in is the denition of the nancial rights in terms of the shadow prices associated with the physical constraints on the storage facilities. This is analogous to the denition of owgate rights (FGRs) in the context of open access transmission. And, as a result, such a denition of nancial storage rights is naturally endowed with advantages and disadvantages comparable to those of FGRs in the context of transmission.

https://ecommons.cornell.edu/handle/1813/51671